November 6, 2019, the twenty-second China plastic recycling and regeneration of the General Assembly held in Jiangsu Suzhou Jinji Lake International Conference Center. Wang Bingli, director of IHS Markit chemical industry and manager of polyolefin in China, delivered a speech on the theme of "the impact of global general resin supply peak on recycled materials".

1 polyethylene

Global synthetic resin supply enters peak period

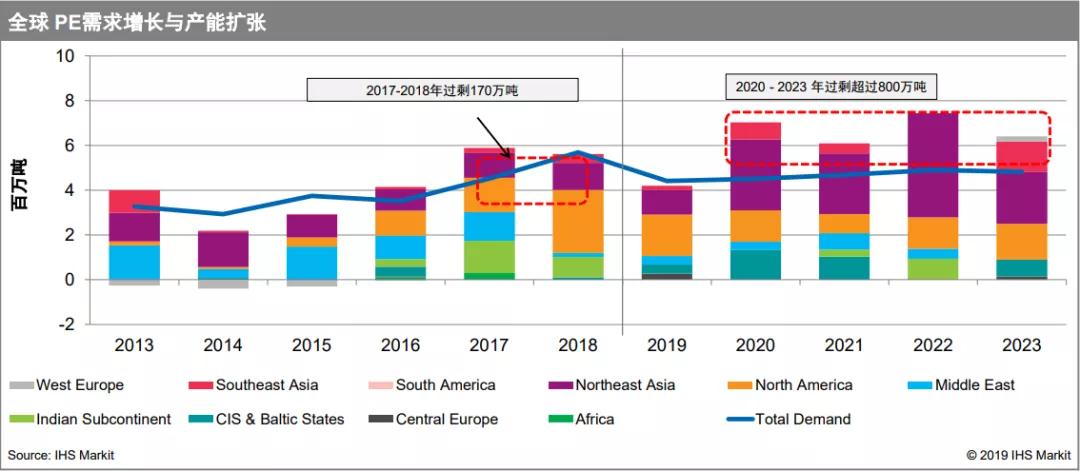

Polyethylene is the largest type of synthetic resin. By 2018, the global demand for polyethylene has reached 102 million tons. The growth rate of global demand is higher than that of global economy. The growth rate of demand in the first five years is 4.5%. It is expected that the growth rate in the next five years will be 4.2%, and the net growth demand in one year will be between 4.2-4.5 million tons.

Supply: since 2001, global supply has experienced two supply peaks, one in 2009, one in 2010, one in 2017 and one in 2018. It is not surprising that the previous peak is compared with the expansion in 2020-2022. In 2020, the global capacity expansion is 1.8 times of the demand growth, about 1.7 times in 2021, and about 1.9 times in 2022. The history of oversupply time span is rare.

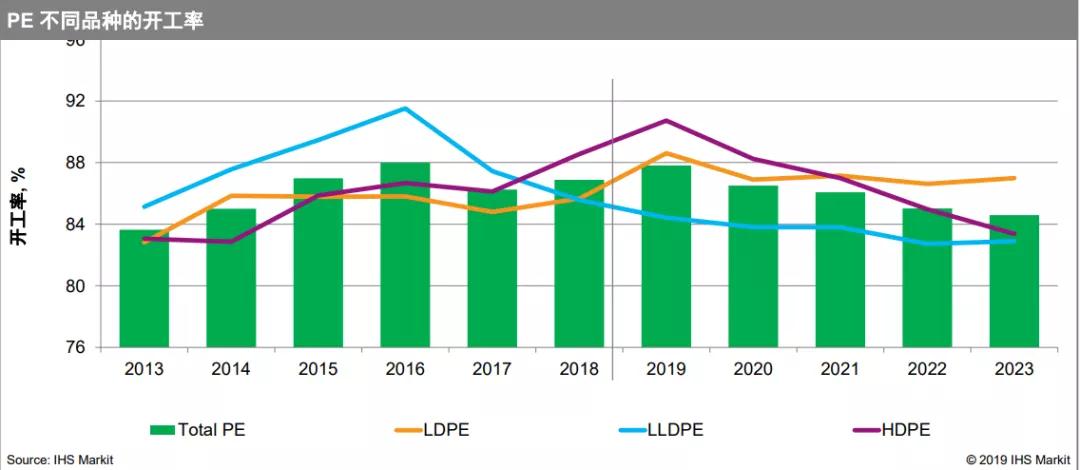

PE utilization rate continues to decline after 2019

Operating rate: Due to the expansion of production capacity, the operating rate has dropped significantly. In the historical trough period, the operating rate of polyethylene generally maintained at 82-84%, and the peak was less than 90%. In the next few years, the global average operating rate will continue to decline, falling to about 82%. In terms of varieties, linear low-density polyethylene declined the most, followed by low-pressure polyethylene, but the capacity expansion trend of high-pressure polyethylene slowed down, and the operating rate was slightly higher.

2Polypropylene

Global PP supply is tight before 2019, with oversupply in 2020-2021

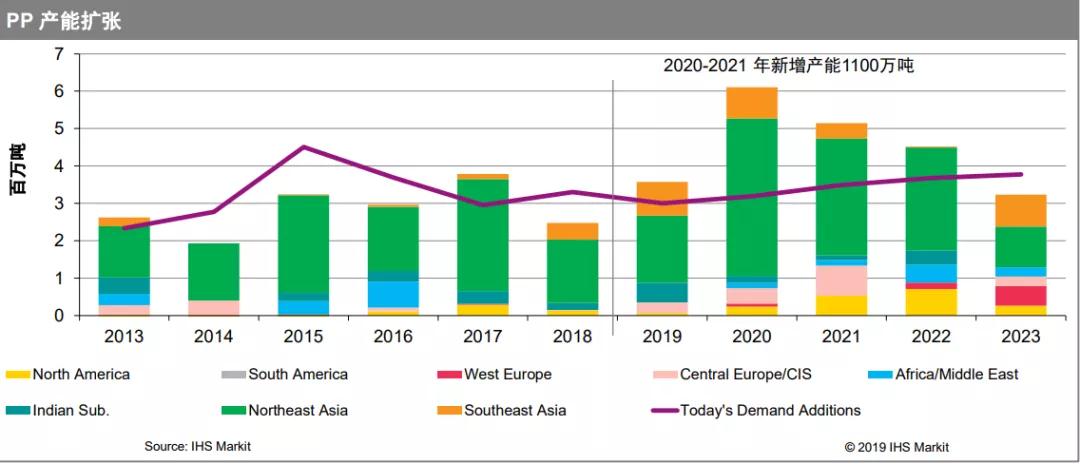

Polypropylene is the second largest variety of synthetic resins. As of 2018, global demand for polypropylene was 73.6 million tons. In the first five years, the average annual growth rate was 5.5%, which is higher than that of polyethylene. It is expected that the growth rate of demand in the next five years will remain at 4.5%, and the annual increase in demand will remain at 3.2 million tons.

Capacity Expansion: Since 2001, global polypropylene capacity expansion has experienced an expansion peak in 2009 and 2010. From 2010 to 2019, polypropylene production capacity expansion is not much. But between 2020 and 2022, capacity expansion will suddenly accelerate. Capacity expansion in 2020 will be 2.2 times the growth in demand, and about 1.7 times in 2021. Supply pressure will be greater in the short term.

Global PP operating rate peaked and fell, but still higher than PE

Operating rate: the global operating rate will drop from a high of 90% in 2019 to 85% or 86%. Because the capacity expansion of polypropylene is mainly concentrated in China, the operating rate of China has declined sharply, from 90% to 80%, lower than that of the world.

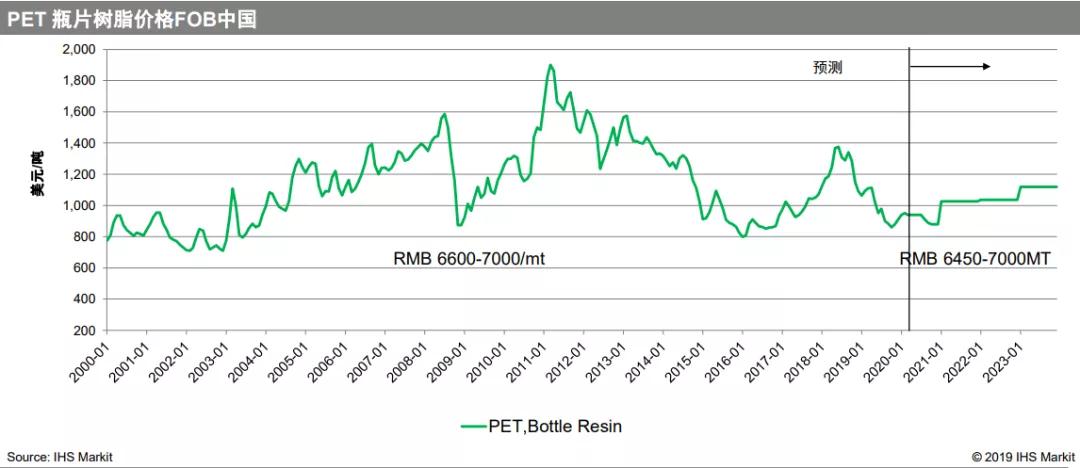

3PET

Global pet starts a new round of capacity expansion

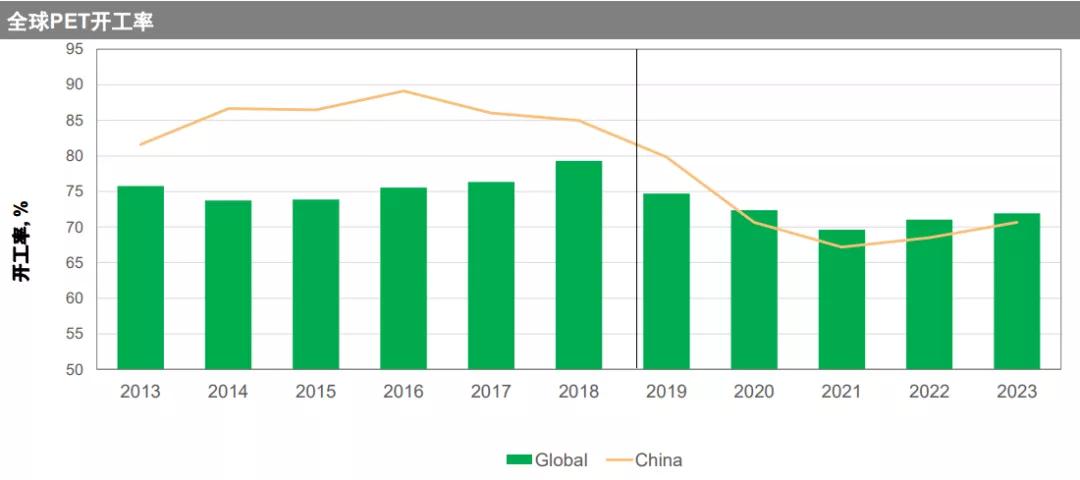

As of 2018, the global demand for PET bottle chips is 34 million tons, with an average annual growth rate of 4.5% in the first five years of 2018. It is expected to be 3.8% in the next five years, with an annual demand increase of 950000 tons. In the next three years, the capacity expansion will be about twice the growth of demand, and the excess time will be relatively long, with three years.

Global pet operating rate continues to decline, especially in China

Operating rate: Generally speaking, the operating rate is not high, because of the fierce competition in the industry, the operating rate has declined to about 70%, and the operating rate in China has declined more, falling below 70%.

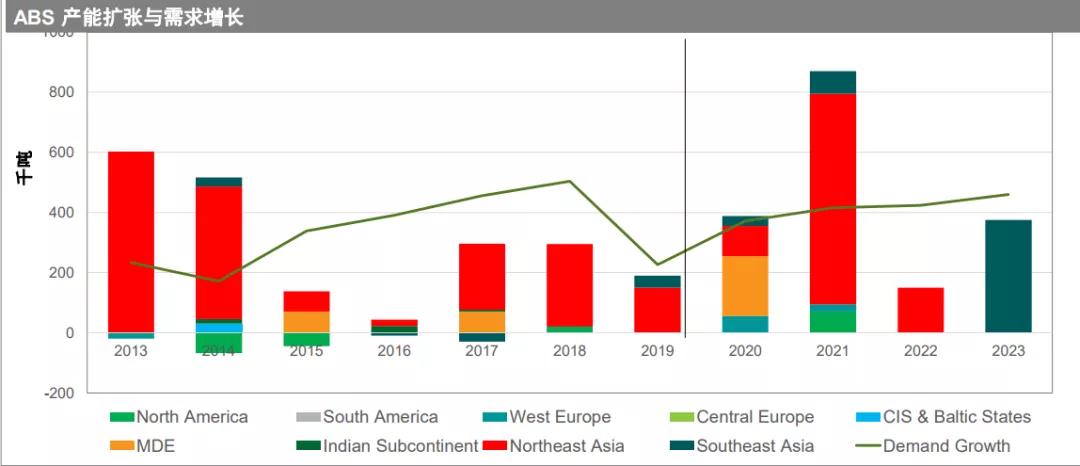

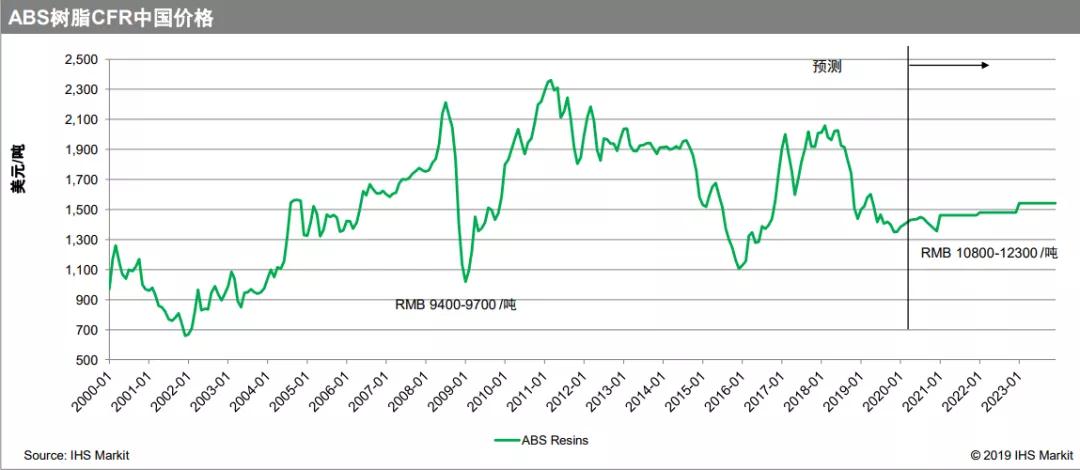

4ABS

Global ABS capacity peak in 2021

As of 2018, the global consumption is 9.3 million tons, with a growth rate of 4.9% in the first five years. It is estimated that the next five years will be 4.5%, with a net increase of 430000 tons per year. ABS is different from other varieties. The capacity expansion is mainly concentrated in 2021, and the capacity expansion will be about twice of the demand growth. Compared with the first three varieties, the expansion cycle is shorter and the impact is smaller.

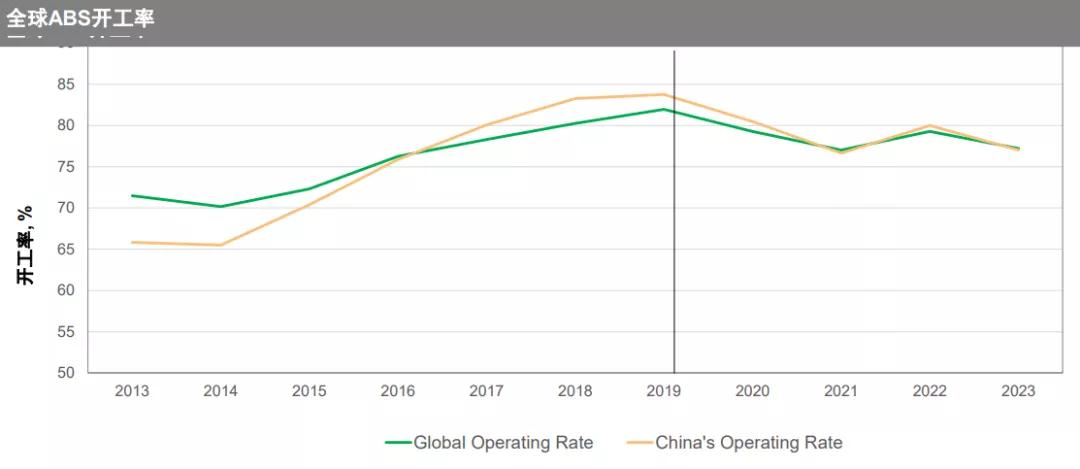

Global ABS starts to decline

Operating rate: compared with other varieties, the decline is not so large, ABS operating rate is not particularly high, the high level is about 84%. It has been declining since 2020, to about 78% by 2021. Compared with the past, the operating rate of the future supply peak is higher than the previous peak.

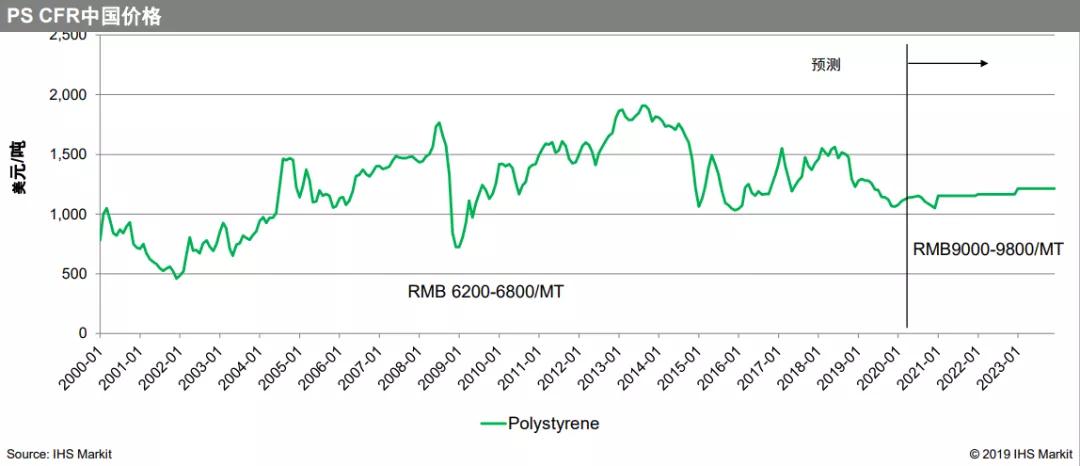

5PS

The global PS expansion has declined sharply, but the demand growth has been hovering

The demand of PS industry is in a state of shrinking, and the demand growth is relatively slow. By 2018, the global consumption is 11 million tons. The annual growth rate of the first five years is very low, which is 0.7%. It is estimated that the annual growth rate of the next five years is 1.2%. From the perspective of capacity expansion, the industry demand is in a state of shrinking. Basically, there is not too much capacity expansion. Some industries, like Europe, need to exit, so the capacity of PS will not increase much in the next few years. Driven by weak demand, the global operating rate is slowly increasing, from the current low of 70% to about 74%. From China's perspective, the operating rate will increase from 60% to 70%. Although PS is very good, its demand potential is relatively small.

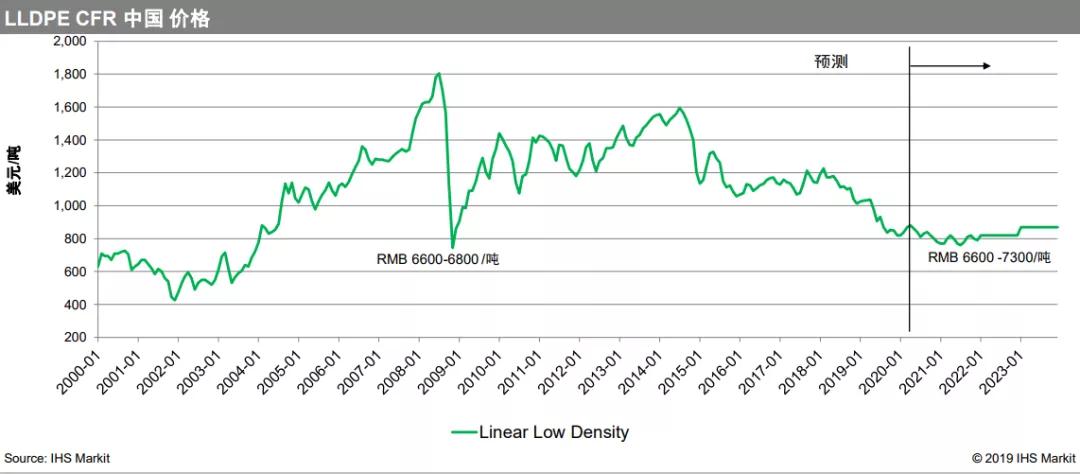

At present, the price of linear low-density polyethylene in U.S. dollar has dropped to the low level of 2008 economic crisis, 780-800 U.S. dollars / ton, and the price of RMB is 7100-7400 yuan / ton. It is estimated that the future price will be US $780-850 / ton, hovering at 7000 yuan / ton, or below 7000 yuan / ton in extreme cases.

Why is the price forecast so low? It's based on crude oil prices. It is predicted that the average level of crude oil price in 2020 will remain above and below US $58 / barrel, and that of naphtha will be US $490 / ton; it is predicted that the crude oil price in 2021 will be US $53 / barrel, and that of naphtha will be US $445 / ton. Asia, especially northeast Asia, is a high-end cost area in the world. If we want to achieve market balance, we must get rid of the surplus, so we have to fall below the cost. In the context of oversupply, the price of polyethylene will fall below cost. Historically, when crude oil price fluctuates by $10 / barrel, the corresponding fluctuation of polyethylene production cost is $100-110.

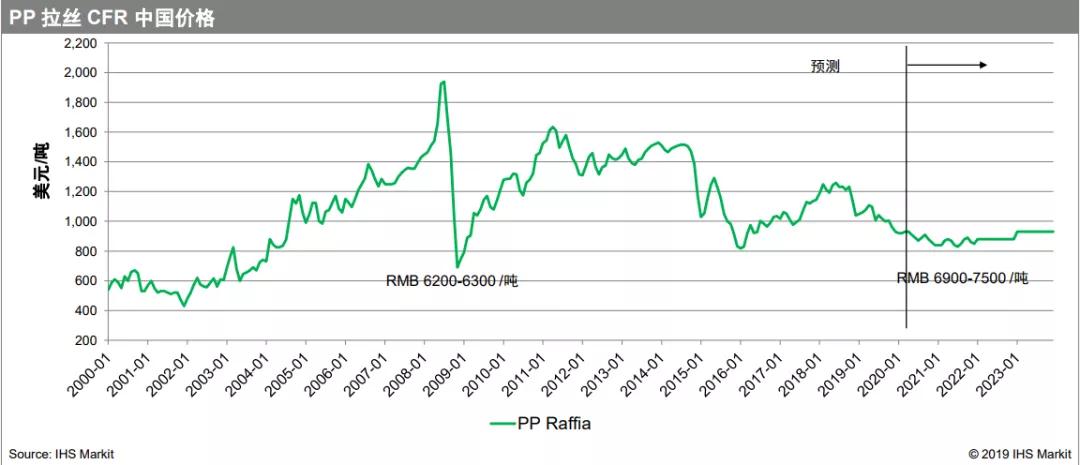

2 Asia PP price forecast

At present, the spot price of polypropylene is relatively high, at the level of 8400-8600 yuan / ton. During the 2008 financial crisis, it was at the level of 6200 or 6300 yuan / ton, which was also at the beginning of 2016. In 2018, the price of USD is 690 or 700 USD / ton. At present, the price of USD remains at 970 or 980. It is expected that the market will slide down in the future. The US dollar will slide to 870-880 US dollars / ton, and the RMB will slide to 7300-7800. The fluctuation in this range may be 2020 or 2021.

3 price forecast of PET bottle sheet resin in Asia

The price of PET bottle chip resin is maintained at 6450-6600 yuan, and the US dollar price is 840-860 US dollars / ton. At present, the price has fallen below the record low of 6600-7000 yuan / ton in 2008. In view of the long time of excess supply and demand, the price will linger in the low position for a long time in the future.

4 price forecast of ABS resin in Asia

ABS is a little better than other varieties. At present, the price is between 10800-12000 yuan / ton. According to different varieties, the worst variety also falls below 10000 yuan / ton when the price is the lowest. But now the average level is OK. The price forecast of US dollars is basically between 1300-1400 dollars / ton. During the 2008 financial crisis, the lowest price of ABS was between 9400-9700 yuan / ton, and the price of US dollar was 1020 dollars / ton, which may maintain a relatively strong momentum in the short term. By 2021, the price may be depressed again, but on the whole, it will be better than other varieties, and the time is relatively short, only one year in 2021.

5 Asia PS price forecast

The price of PS is basically about 9000, and it is expected that there will be little difference in the next few years. Because there is not much supply and the price is relatively high, it is better than other varieties. During the 2008 financial crisis, the price was relatively low. The price in US dollars was 720-730 US dollars per ton, and the price in RMB was more than 6000 yuan per ton.

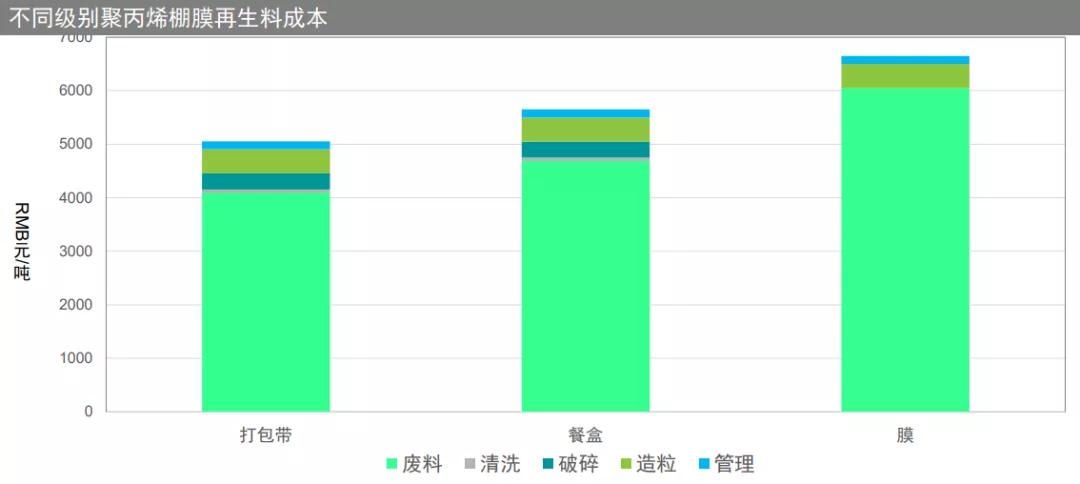

Cost of recycled material

Cost of recycled polyethylene film for greenhouse

Based on the waste shed film, the industry knows that the base material is divided into 90 materials, 85 materials and 80 materials. The domestic material is basically 80 materials, and the unit price is 4000 yuan / ton. According to this calculation, the cost of the first level recycled material varies from 5300-5900 yuan / ton, excluding tax.

Production cost of primary recycled materials from different waste polypropylene base materials

The price of packing belt gross material is 3500 yuan / ton, lunch box gross material 4500 yuan / ton, waste film 5500 yuan / ton, and the corresponding cost of recycled material 5050 yuan / ton, 5650 yuan / ton, 6650 yuan / ton, excluding tax.

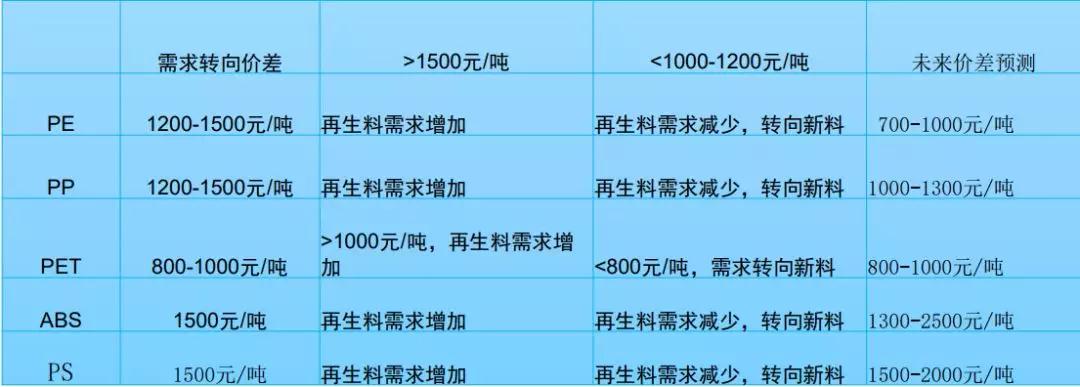

Price difference between new material and recycled material leads to demand conversion

The higher the price of new materials, the larger the living space of recycled materials. When the price of new materials is more than 8800 yuan / ton, the living space of recycled materials is larger; if the price of raw materials drops sharply, and falls below 8000 yuan, the living space of recycled materials will be smaller and smaller. After market investigation, the price difference between new material and recycled material (level I) is 1200-1500 yuan / ton. When the price of new materials drops sharply, the price difference will be compressed below 1200 yuan / ton, and the living space of recycled materials will be smaller and smaller. If the price difference between new material and recycled material reaches 2000 yuan / ton and 3000 yuan / ton, the recycled material industry will be prosperous.

Judgment of future price difference: the price difference between polyethylene new material and recycled material is basically maintained in the range of 700-1000 yuan / ton; PP is relatively good, at 1000-1300 yuan / ton; pet800-1000 yuan / ton; there are many kinds of ABS, the price difference is relatively large, which may be 1300 yuan / ton in the downturn, 2500 yuan / ton in the high, slightly better; PS price difference is 1500-2000 yuan / ton, because there is no new capacity, The price difference is quite large. Generally speaking, ABS and PS are the best price differentials, while the price differentials of other varieties are relatively poor.

The influence of the price of polyethylene resin on the demand of recycled materials

When the price of pure resin is more than 9000 yuan / ton, the demand for recycled materials is strong and the living space is large. For example, during the first half of 2004-2008 and 2012-2013, the price of raw materials was very high. In order to reduce costs, more recycled materials were used, so the demand for recycled materials increased significantly. When the price of raw materials falls below 8000 yuan / ton, due to the decrease of raw material cost, customers tend to select new materials basically, and the demand for recycled materials drops. For example, from October 2008 to the first half of 2009, as well as 2015 and 2016, it is quite obvious. However, in 2017 and 2018, due to the ban on the import of waste plastics, the demand for recycled materials decreased, which was not included. It can be seen from this that in the next few years, due to the relatively low price of all polymers, the proportion of pure resin replacing recycled materials will increase in the next few years, and the demand for pure resin will grow strongly, while the demand for recycled materials will decline, and the living space will be squeezed.

Conclusion

1. In 2020, the global plastic industry will usher in a new round of capacity expansion peak, with a sharp decline in the operating rate.

2. PE / PP / Pet surplus is serious, and some enterprises, especially in Northeast Asia, will face loss.

3. ABS supply peak is later than other products, and the peak time is shorter.

4. PS capacity has almost no expansion, but the demand growth potential is small.

5. The long-term low price of new materials has seriously squeezed the living space of recycled materials, especially PE, PP and pet. The profit potential of ABS and PS recycling enterprises is large.

<Get recycling , professional supply plastic recycling solutions ,http://www.get-recycling.com/>

<PET bottles recycling solution , http://www.get-recycling.com/solutions_show.asp?id=12>

<HDPE/PP bottles recycling solution , http://www.get-recycling.com/solutions_show.asp?id=11>

<LDPE film recycling solution , http://www.get-recycling.com/solutions_show.asp?id=8>